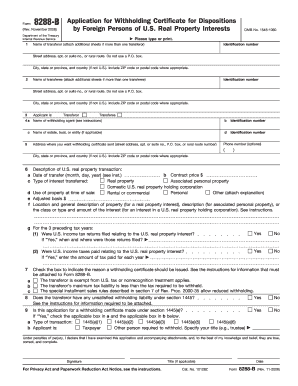

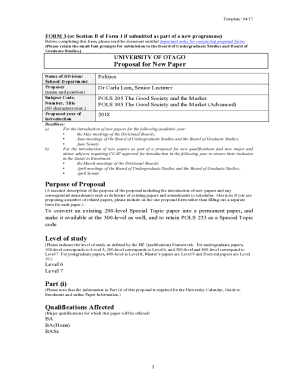

IRS 8288-B 2016-2025 free printable template

Instructions and Help about IRS 8288-B

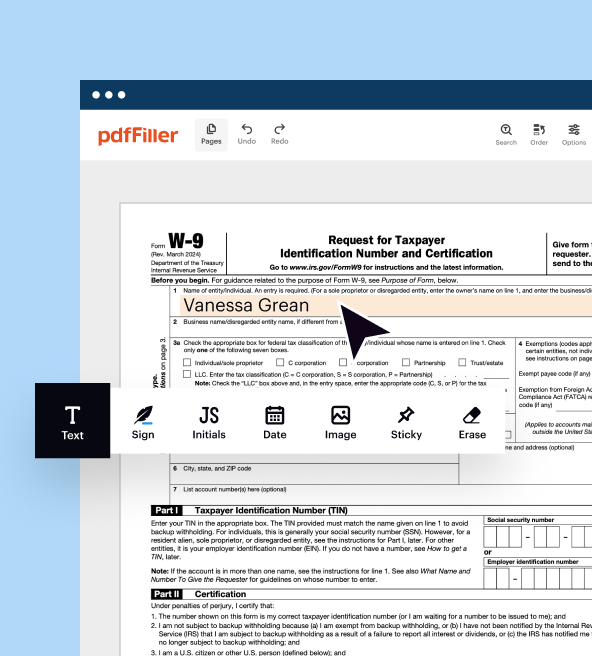

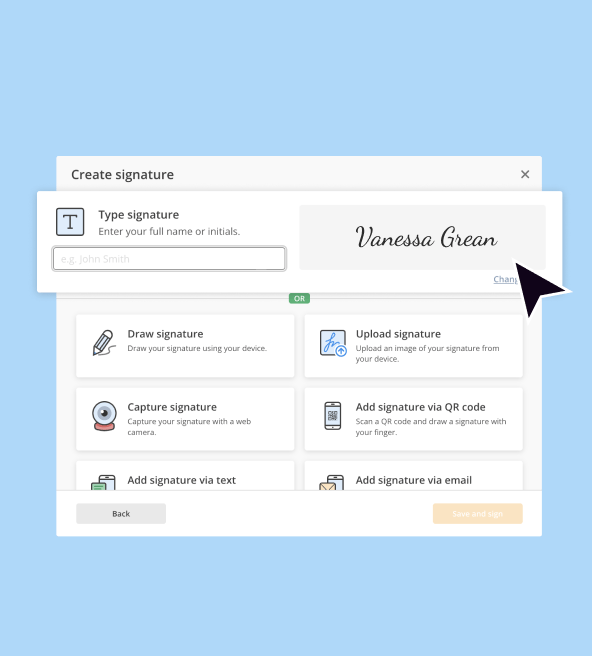

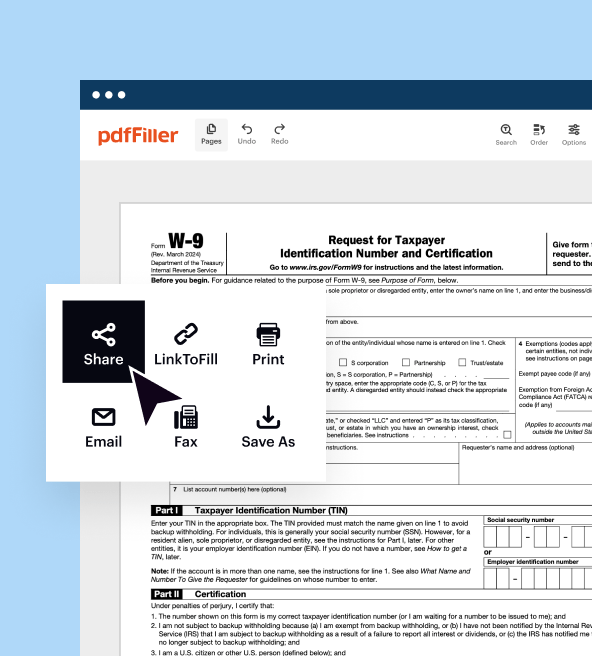

How to edit IRS 8288-B

How to fill out IRS 8288-B

Latest updates to IRS 8288-B

All You Need to Know About IRS 8288-B

What is IRS 8288-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8288-B

What should I do if I need to amend my IRS 8288-B submission?

If you need to amend your IRS 8288-B, you should prepare a corrected form and follow the required procedures for submission. Ensure that all updated information is accurate, and indicate that it's an amended return. Keep records of both the original and amended submissions for your files.

How can I verify the status of my IRS 8288-B submission?

To verify the status of your IRS 8288-B submission, you can contact the IRS directly or check any online resources provided by the IRS for tracking your filing. Be prepared to provide your personal information and details about the submission to receive accurate updates.

What common errors should I watch for when filing the IRS 8288-B?

Common errors to avoid when filing the IRS 8288-B include incorrect taxpayer identification numbers and missing signatures. Double-check all entries for accuracy and ensure that every required section of the form is fully completed before submission.

See what our users say