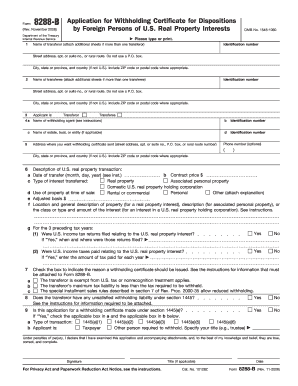

IRS 8288-B 2016-2025 free printable template

Get, Create, Make and Sign il w 4 form

Editing firpta withholding certificate online

IRS 8288-B Form Versions

How to fill out form 8288 b withholding

How to fill out IRS 8288-B

Who needs IRS 8288-B?

Video instructions and help with filling out and completing w 4 definition

Instructions and Help about firpta withholding

All right in this video I wanted to cover IRS form 8288 this is a form that is filed when you as a buyer purchase real estate that is owned by a non-us person so if you're a buyer of a piece of real property in the United States and the seller on the other end of this thing is not a U.S. person which is quite common these days you as the buyer are going to be obligated under the tax code to withhold tax on the sale of that property file this form and then pay the withholding tax to the IRS now this rule exists because under the internal revenue tax code the sale of U.S. property by a foreign person is subject to tax right it's U.S. source effectively connected income, but most foreign persons don't have to file tax returns so in order to make sure the IRS gets their cut of the money you as the buyer have to do this so in this example we have this is a real estate investment partnership, so it's an LLC filing a form 1065 every year, so it's a real estate partnership based out of...

People Also Ask about section 1445

What is the penalty for filing form 8288?

What is the penalty for filing form 8288 late?

What is the processing time for form 8288-B?

What is the difference between 8288-A and 8288-B?

Which of the following is a common mistake on the Forms 8288 and form 8288-A?

What is IRS form 8288-B for?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in irs withholding property?

How can I edit certificate of non foreign status irs on a smartphone?

How do I edit irs 8288 b on an Android device?

What is IRS 8288-B?

Who is required to file IRS 8288-B?

How to fill out IRS 8288-B?

What is the purpose of IRS 8288-B?

What information must be reported on IRS 8288-B?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.